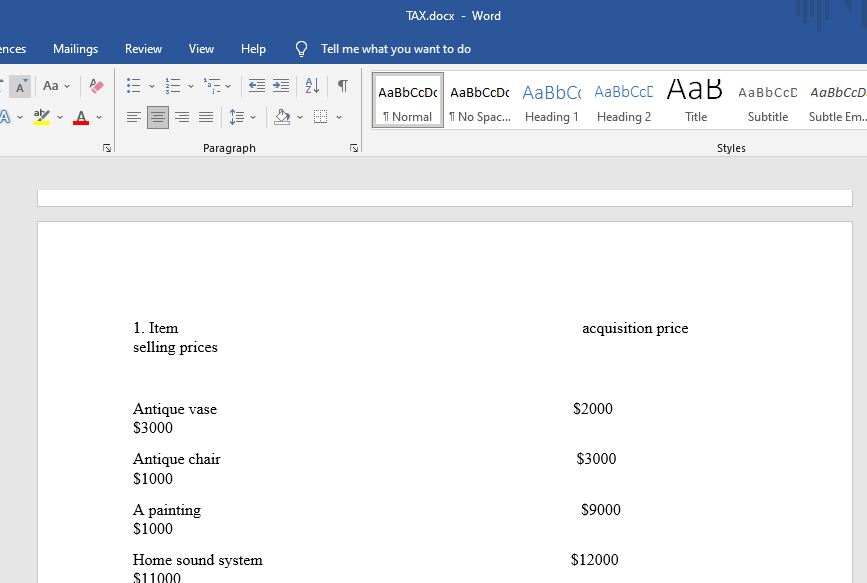

Calculate net capital gain or loss

QUESTION 1

Over the last 12 months, Eric acquired the following assets: an antique vase (for $2,000), an antique

chair (for $3,000), a painting (for $9,000), a home sound system (for $12,000), and shares in a listed

company (for $5,000). Last week he sold these assets as follows: antique vase (for $3,000), antique

chair (for $1,000), painting (for $1,000), sound system (for $11,000) and shares (for $20,000).

Calculate his net capital gain or net capital loss for the year.

Question 2

Brian is a bank executive. As part of his remuneration package, his employer provided him with a

three-year loan of $1m at a special interest rate of 1% pa (payable in monthly instalments). The loan

was provided on 1 April 2016. Brian used 40% of the borrowed funds for income-producing purposes

and met all his obligations in relation to the interest payments. Calculate the taxable value of this

fringe benefit for the 2016/17 FBT year. Would your answer be different if the interest was only

payable at the end of the loan rather than in monthly instalments? What would happen if the bank

released Brian from repaying the interest on the loan?

Question 3

Jack (an architect) and his wife Jill (a housewife) borrowed money to purchase a rental property as

joint tenants. They entered into a written agreement which provided that Jack is entitled to 10% of

the profits from the property and Jill is entitled to 90% of the profits from the property. The

agreement also provided that if the property generates a loss, Jack is entitled to 100% of the loss.

Last year a loss of $10,000 arose. How is this loss allocated for tax purposes? If Jack and Jill decide to

sell the property, how would they be required to account for any capital gain or capital loss?

Question 4

What principle was established in IRC v Duke of Westminster [1936] AC 1? How relevant is that

principle today in Australia?

Question 5

Bill owns a large parcel of land on which there are many tall pine trees. Bill intends to use the land

for grazing sheep and therefore wants to have it cleared. He discovers that a logging company is

prepared to pay him $1,000 for every 100 meters of timber they can take from his land. Leaving

aside any capital gains tax issues, advise Bill as to whether he would be assessed on the receipts

from this arrangement. Would your answer be different if he was simply paid a lump sum of $50,000

for granting the logging company a right to remove as much timber as required

Answer preview:

Words: 339